Elmore R. Alexander

Originally published by Optimal Partners on April 21, 2021

The challenges facing higher education institutions are monumental. It is clear that academic business models are struggling to keep up with the enrollment declines and cost escalations that have resulted in severe financial pressures. The global pandemic has just made underlying cracks in the models into crevasses.

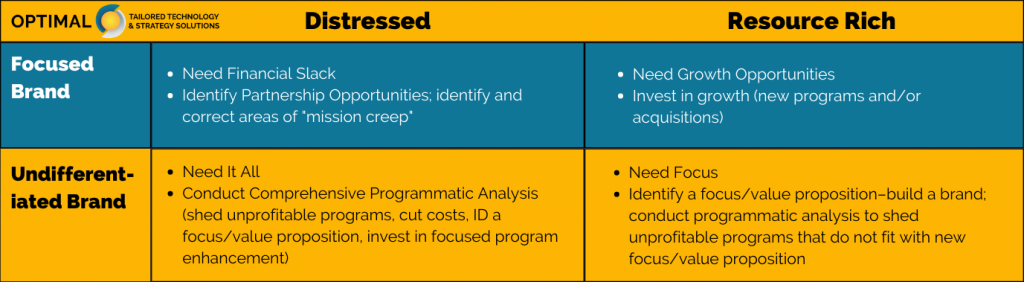

An effective way to understand where your institution is during these challenging times and to design a pathway to a stronger business model is presented in the following matrix. Two perspectives for examining your current business model are presented—”Brand Position” and “Financial Position.” From the perspective of “Brand Position,” institutions can be seen as varying from being undifferentiated where program offerings are merely a loose combination of unrelated programs to being highly focused where programs clearly fit into an organized theme presenting a clear value proposition to potential students and their parents. From the perspective of “Financial Position,” institutions move from distressed (facing existential threats in the near term) to resource-rich (having surplus funds or financial leverage that would allow investment in new opportunities).

Obviously, institutions in the undifferentiated and distressed cell are at the greatest risk. They lack both a focus and financial resources. This is the position in which many small private colleges find themselves. Such institutions need to undertake serious analysis and redefinition of their business models. They need to:

- conduct a comprehensive analysis that identifies their value proposition in the

marketplace, - analyze the fit of current programming to that value proposition,

- assess the financial health of programs (shedding programs with net negative contributions that are not critical to the institution’s value proposition),

- find administrative and IT efficiencies, and

- focus operational planning on improving the financial health of the institution.

Institutions with focused brands but financial distress nonetheless are still at substantial risk. Given the plummeting of state support, declining demographics, and competition from both small privates and flagship state institutions trying to sustain enrollments, many regional state universities find themselves in this quadrant. Such institutions may well benefit from strategies to partner with other institutions to achieve cost savings. Despite the focused brand of such institutions, we often find that over time through “mission creep” or other dynamics, numerous programs outside of the brand focus have been added. Serious analysis of the financial health of these programs as well as exploration of administrative efficiencies and other operational strategies for improving the financial health of the institution are appropriate.

The challenges to institutions whose financial health is relatively secure are quite different. These institutions include large undifferentiated public and private institutions that have grown by being “comprehensive” but now lack a focus and identity. For those with an undifferentiated brand, a serious analysis of the institution’s value proposition and an articulation of that proposition that can guide growth and development are in order. Once a value proposition is agreed to by institutional stakeholders, a financial analysis of programs is appropriate. Programs that are inconsistent with the institutional value proposition should be candidates for elimination. Savings can be used as investment funds for both new programs that are consistent with the value proposition as well as the shoring up of underperforming programs that are value consistent.

The ideal spot for an institution is to be resource-rich with a focused and distinctive brand. These institutions include the Ivy’s, other high-profile privates, and many of the flagship state institutions. At the same time, however, there are privates who have ridden regional growth, aggressive marketing, and/or investment in nationally focused online programs to this stature. The University of Southern New Hampshire and High Point University are notable examples. Such institutions are primed for growth. Growth can come by adding new programs that enhance the brand, by acquiring programs from other institutions, or by acquiring other entire institutions. Even in resource-rich institutions, there are savings to be found by examining the financial health of individual programs and exploring administrative efficiencies and improvements in operational strategies.

This is the first in a blog series that we are entitling “Strategic Positioning for Institutional Viability.” Over the course of the next two months, we will be looking more closely at financial and programmatic models of higher education. We will present tools for understanding your institution’s performance beginning with a discussion of “benchmarking” in a couple of weeks. Additionally, we will introduce concepts from financial analysis such as “minimum viable product” illustrating how their use in higher education could help institutions analyze their mix of academic programs. We will also look at the challenges of introducing financial analysis techniques in academe discussing topics such as the importance of openness regarding budget information to faculty, staff, students, and other constituents. Finally, we will look at the concept of the “institutional value proposition” as a guide to program development and the positioning of the institution in the academic marketplace.

Elmore R. Alexander is a partner in ELM2 Advisors and a current member of the Governing Board of Les Roches International School of Hotel Management (Switzerland). He is the former business school dean at Marist College, Bridgewater State University and Jefferson University.